straight life policy develops cash value

C It usually develops cash value by the end of the third policy year. Into the cash value.

:max_bytes(150000):strip_icc()/dotdash_Final_Top_3_Pitfalls_Of_Discounted_Cash_Flow_Analysis_Feb_2020-01-a5c2306a3b294872a505aa63bd2cea7e.jpg)

Top 3 Pitfalls Of Discounted Cash Flow Analysis

The gross amount of collections expected to be obtained through the liquidation of assets in an asset pool.

. The face value of the policy is paid to the. The cash value component of a life insurance policy is. Face value of policy is paid at age 100 B.

Initial Targeted Cash Value. This is a straight life annuity that starts paying you back as soon as you acquire it. Ten years later your policys cash value has grown to 750000.

Which statement is NOT true regarding a Straight Life policy. For example suppose you take out a whole life insurance policy for 100000. The face value of the policy is paid to the insured at age 100.

Premium steadily decreases over time in response to its growing cash value. Toward the cost of actually insuring you. Yearly Price Of Protection Method.

Ad Compare the Best Life Insurance Providers. Which statement is NOT true regarding a Straight Life policyA. Reviews Trusted by 45000000.

The face value of the policy is paid to the insured at age. The initial targeted cash value or. Straight Life policies charge a level annual premium throughout the insureds lifetime and provide a level guaranteed death.

In addition to a death benefit for your beneficiary and cash value for you straight life insurance offers a variety of benefits not found in other policies. As a form of permanent life insurance straight life insurance comes with a cash value account that will grow over the life of the plan. As a form of permanent life insurance straight life insurance comes with a cash value account that will grow over the life of the plan.

Once a cash value begins to accrue it becomes. It usually develops cash value by the end of the third policy year It has the lowest annual premium of the three types of Whole. A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or.

It usually develops cash value by the end of the third policy year. You can even cash in the surrender value of a life insurance policy. A method used in actuarial analysis which is often used in the insurance industry.

The best way to use the cash value in your whole life insurance policy is through a policy loan. Which statement is NOT true regarding a Straight Life policy. Which statement is NOT true regarding a Straight Life policy.

It usually develops cash value by the end of the third policy year. The term straight life single-premium immediate annuity refers to the same thing. Another portion goes to fund the cash value of your policy.

In most cases the cash value doesnt begin to accrue until 2-5 years have passed. Which statement is NOT true regarding a straight life policy. Toward policy fees and changes.

Its premium steadily decreases over time in response to its growing cash value 2. How Much Does a Straight Life Annuity Pay Out. It has the lowest annual premium of the three types of.

The face value of the policy is paid to the insured at age 100. A cash value life insurance provides the holder of the policy a cash value savings component where cash can be utilized for several purposes as loans stock of cash or payment of other. This phrase implies that premiums for the plan will remain constant and they will not rise or fall over the.

The Yearly Price Of Protection Method is used to find out. The total payout amounts depend on several factors including your life. Has the lowest annual.

With cash value life insurance your premium payments go three places. You make 10 years of payments and build up a cash value of 10000. As you are 65 years old now the cost of insuring your life is much higher.

Heres a look at the three options and why a policy loan is often the best solution. The face value of the policy is paid to the insured at age 100. The term straight refers to the whole life insurance policys premium structure.

The face value of the policy is paid to the. Dividends and Interest. Straight life policy has what type of premium.

The rate of return will typically be large enough that. Usually develops cash value by end of third policy year C. Which statement is NOT true regarding a Straight Life Policy.

It usually develops cash value by the end of the third policy year C. Time in response to its growing cash value.

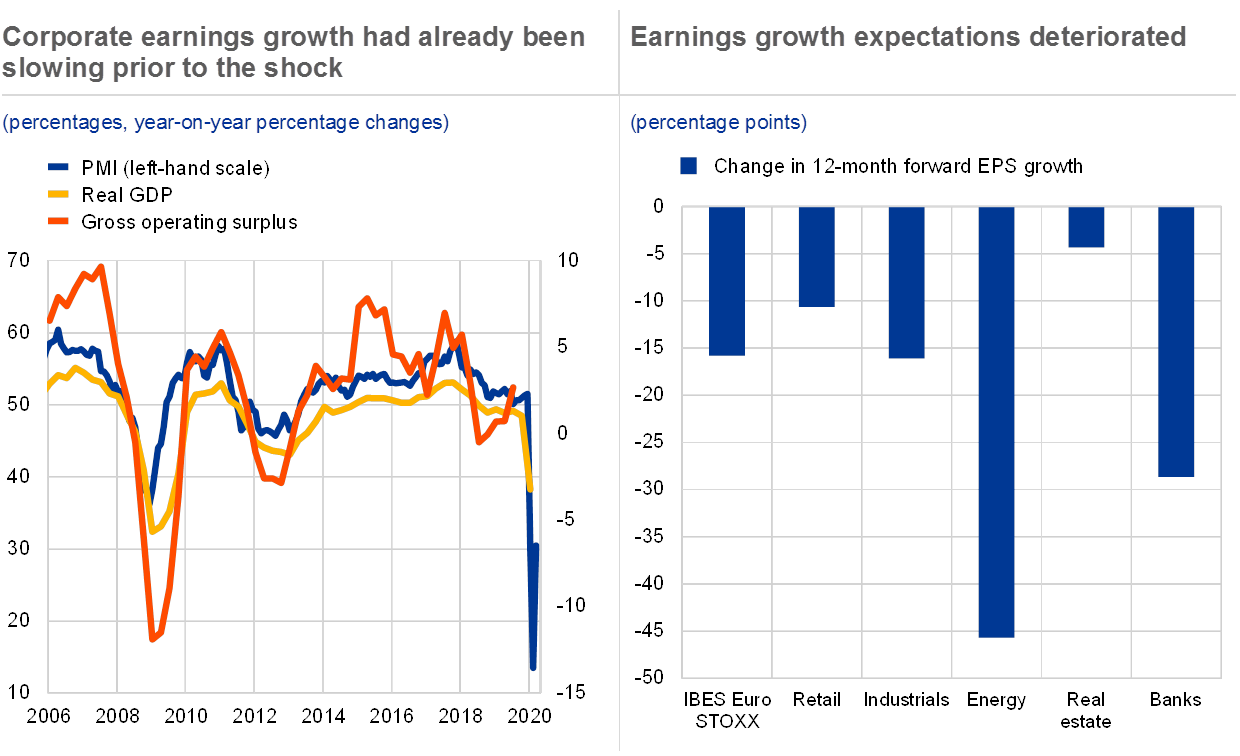

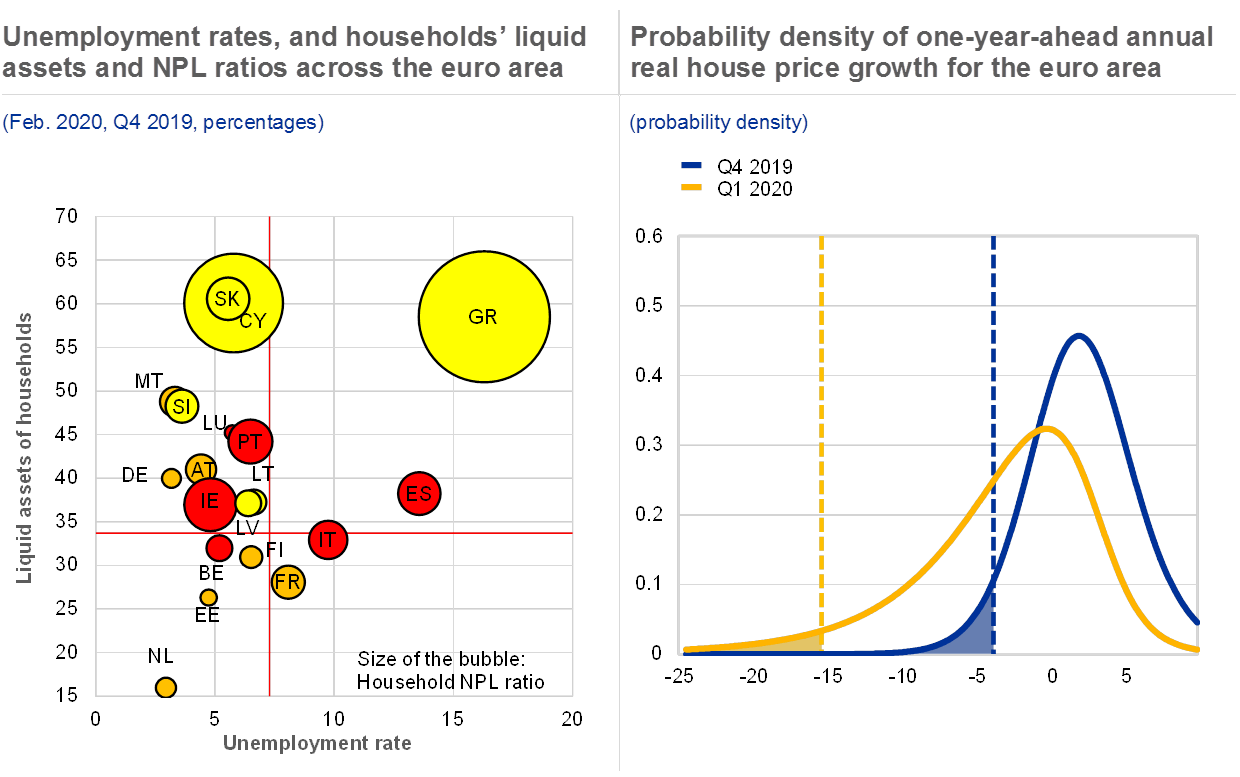

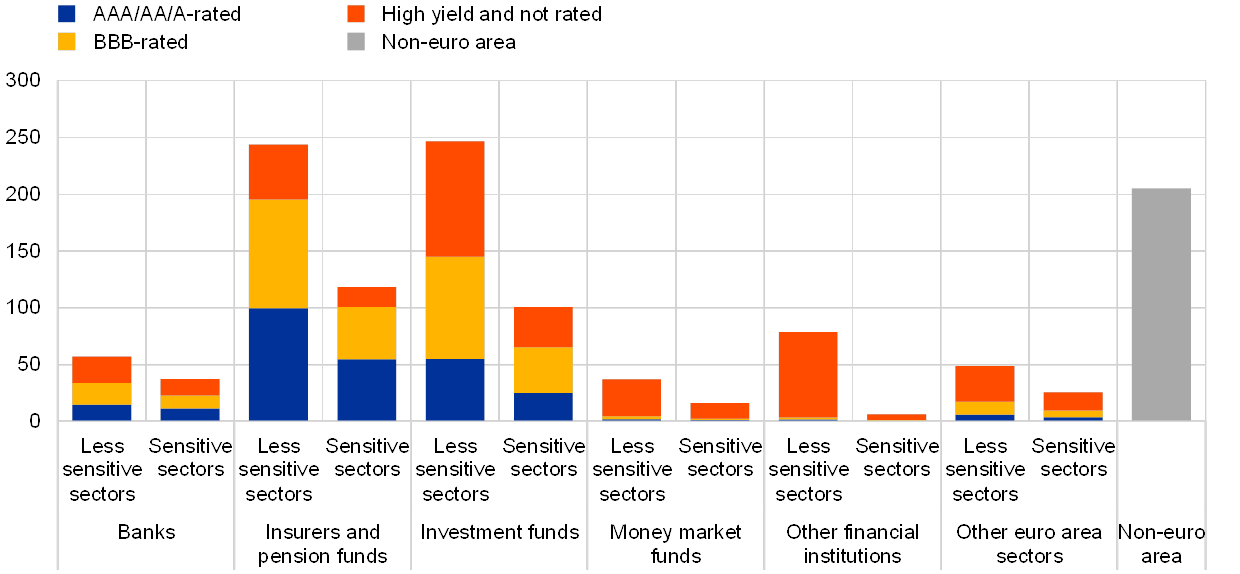

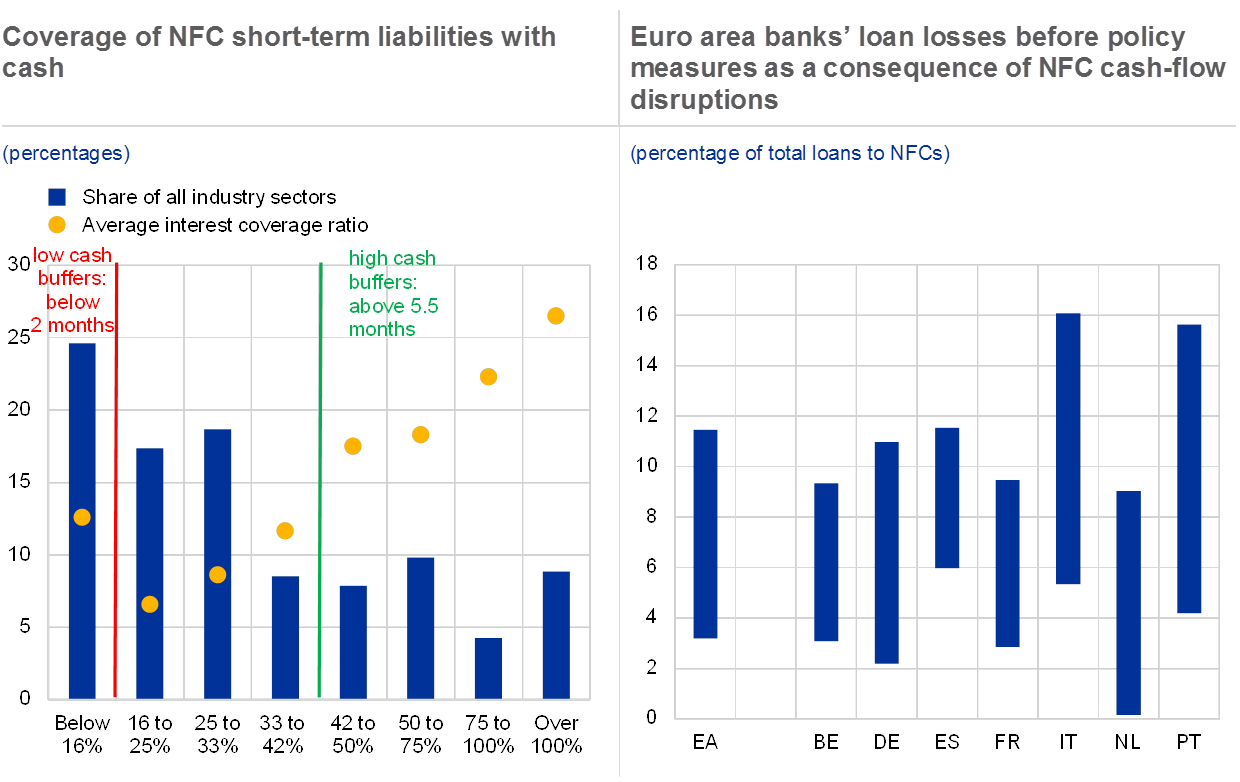

Financial Stability Review May 2020

Quidco Business Model Canvas Business Model Canvas Business Model Canvas Examples Online Business Models

Financial Stability Review May 2020

What Is Straight Life Insurance Valuepenguin

/VolatilitySmileDefinitionandUses2-6adfc0b246cf44e2bd5bb0a3f2423a7a.png)

Volatility Smile Definition And Uses

Financial Stability Review May 2020

What Happens To The Cash Value Of My Life Insurance When I Die

/dotdash_Final_Top_3_Pitfalls_Of_Discounted_Cash_Flow_Analysis_Feb_2020-01-a5c2306a3b294872a505aa63bd2cea7e.jpg)

Top 3 Pitfalls Of Discounted Cash Flow Analysis

What Happens To The Cash Value Of My Life Insurance When I Die

/VolatilitySmileDefinitionandUses2-6adfc0b246cf44e2bd5bb0a3f2423a7a.png)

Volatility Smile Definition And Uses

Financial Stability Review May 2020

Financial Stability Review May 2020

/dotdash_Final_Top_3_Pitfalls_Of_Discounted_Cash_Flow_Analysis_Feb_2020-01-a5c2306a3b294872a505aa63bd2cea7e.jpg)

:max_bytes(150000):strip_icc()/cash_flow-5bfc31ba46e0fb00511acd46.jpg)